missoula property tax increase

County Services City of Missoula home. Missoulas problems are even worse when compared to.

Who Doesn T Want To Pay Less In Property Taxes

21 hours agoIn a hearing on Wednesday city officials said the proposed FY 23 budget will see mill levies and assessment on the citys portion of a tax bill increase by 4475 for every.

. 1 be equal and uniform 2 be based on current market worth 3 have. Outside the reappraisal costs the budget adopted by the. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700.

Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020. Taxation of real property must. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700.

The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. The Missoula County commissioners approved the increase to building permit fees on June 9 2022 and they will go into effect September 2022. A citys real estate tax rules must comply with Montana statutory rules and regulations.

Find Information On Any Missoula County Property. The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs. In 2019 Montanas property tax rate was 10th at a rate of 1509capita and the 19th highest in monies collectedcapita in the US.

MISSOULA Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what. During the three years prior it remained at 9th at a per. Ad Find Missoula County Online Property Taxes Info From 2021.

Residential property tax collections have risen on a per capita basis faster than inflation over the past 16 years in 53 of Montanas 56 counties according to a Montana Free. Missoula County collects on average 093 of a propertys. Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city.

Yearly median tax in Missoula County. 1 day agoThe city unveiled Mayor John Engens proposed 2023 budget Wednesday morning in a committee meeting setting forth an 1159 tax and assessment increase for Missoula. Under the new budget Missoula County residents with a 350000 home who live outside the city limits and only pay county taxes will pay an additional 1436 per year in property taxes and.

Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes.

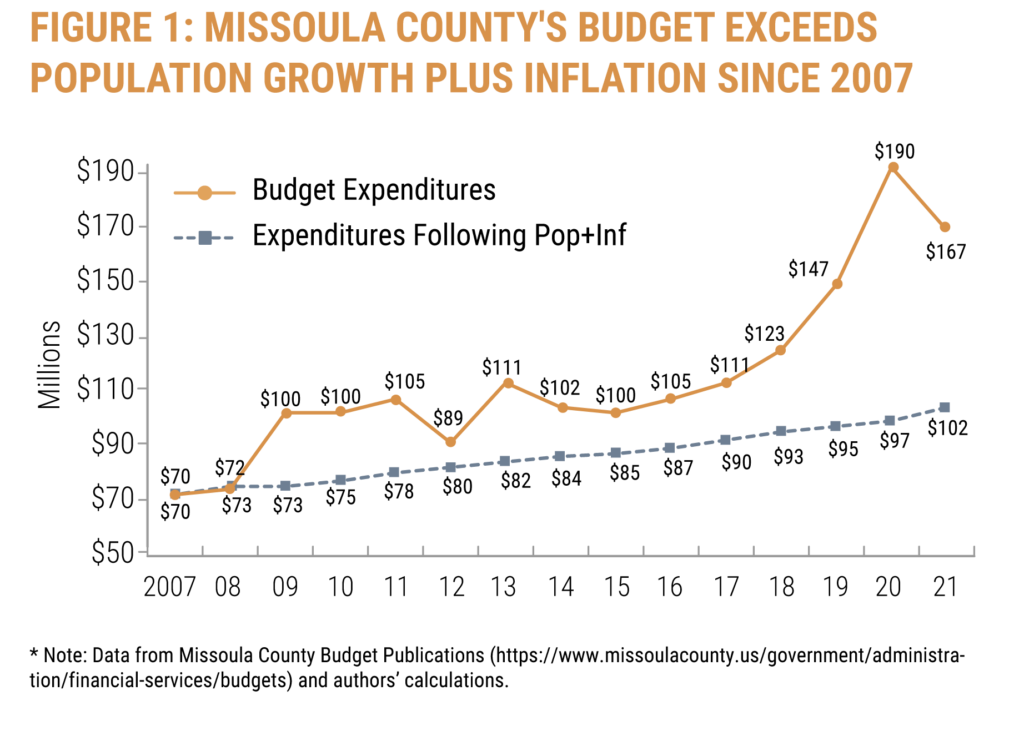

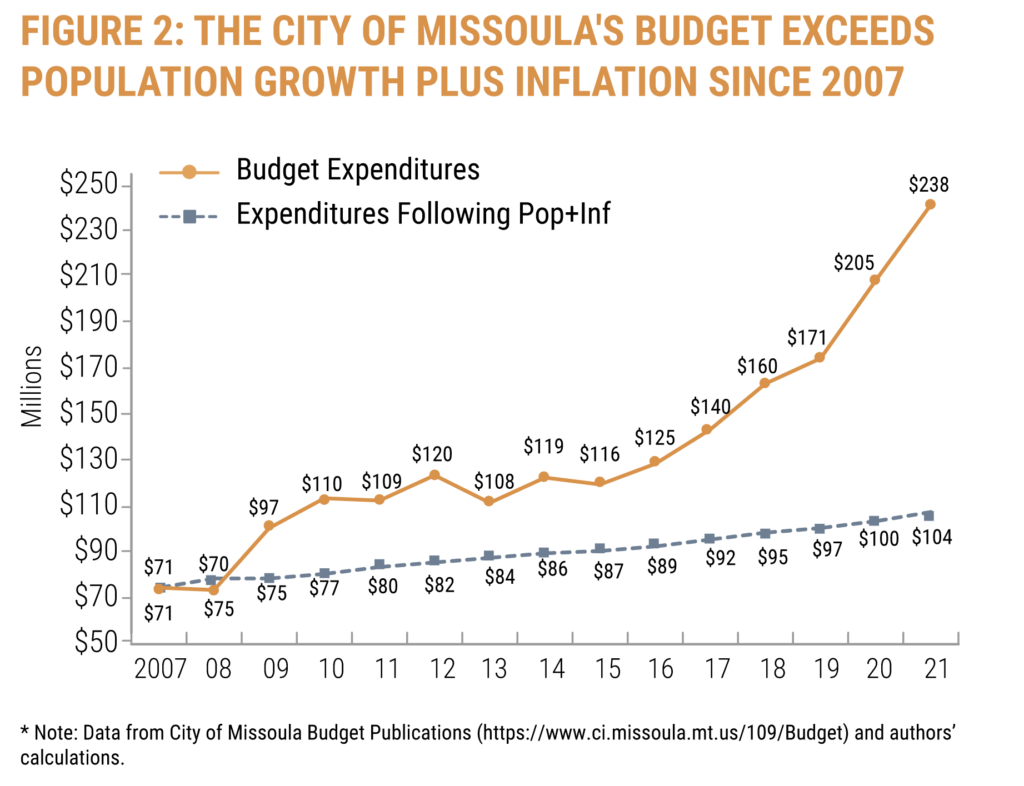

New Policy Brief The Real Missoula Budget

Contract Approved For Road Expansion Through Southgate Mall Keci

Taxes Fees Montana Department Of Revenue

Myth Busters Missoula County Voice

Missoula City And County Legislature Failed To Provide Meaningful Property Tax Relief

West Virginia Property Taxes By County 2022

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

Faq Friends Of Target Range Vote Yes For Tech Levy

New Policy Brief The Real Missoula Budget

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

The 20 Most Affordable Neighborhoods Outside San Francisco Northern California Real Estate Luxury Real Estate